All About Wealth Management

Wiki Article

The smart Trick of Wealth Management That Nobody is Discussing

Table of ContentsSome Ideas on Wealth Management You Should KnowWealth Management - TruthsWealth Management Can Be Fun For EveryoneHow Wealth Management can Save You Time, Stress, and Money.Get This Report about Wealth Management

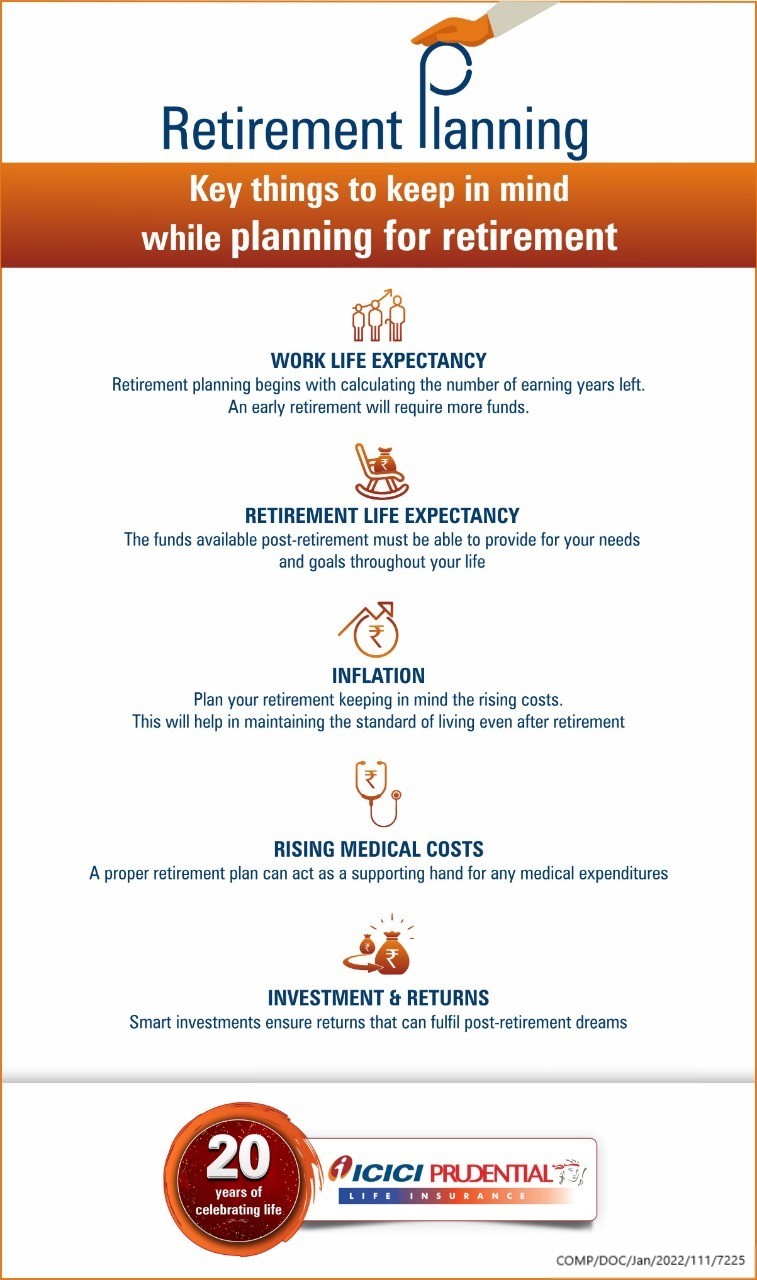

You wish to make sure that your family can endure monetarily without drawing from retirement cost savings ought to something occur to you. As you age, your financial investment accounts must end up being extra conventional - wealth management. While time is running out to save for people at this stage of retirement preparation, there are a few advantages.And it's never ever far too late to establish and also contribute to a 401( k) or an IRA. One advantage of this retired life preparation stage is catch-up payments. From age 50 on, you can add an additional $1,000 a year to your traditional or Roth IRA and an additional $7,500 a year to your 401( k) in 2023 (up from $6,500 for 2022).

Deposit slips (CDs), leading stocks, or certain property financial investments (like a vacation home that you lease out) may be sensibly safe ways to contribute to your nest egg. You can also begin to obtain a feeling of what your Social Protection benefits will certainly be as well as at what age it makes feeling to start taking them. wealth management.

This is additionally the time to look right into long-term care insurance policy, which will help cover the costs of an assisted living facility or house care should you need it in your sophisticated years. If you don't appropriately prepare for health-related costs, especially unanticipated ones, they can annihilate your savings. The Social Protection Administration (SSA) offers an online calculator.

Not known Facts About Wealth Management

It thinks about your full economic image. For a lot of Americans, the solitary biggest asset they own is their home. Exactly how does that suit your retirement strategy? A house was considered an asset in the past, however since the housing market accident, planners see it as less of an asset than they once did.

There may also be modifications boiling down the pipeline in Congress concerning estate taxes, as the inheritance tax amount is scheduled to go down to $5 million in 2026. As soon as you reach retirement age and also begin taking distributions, taxes end up being a large issue. A lot of your retired life accounts are tired as ordinary earnings tax obligation.

The 45-Second Trick For Wealth Management

There's also life insurance coverage and long-lasting care insurance policy to think about. Another kind of policy provided by an insurance coverage company is an annuity.

You placed money on down payment with an insurance business that later pays you an established monthly amount. Retirement planning isn't difficult.

That's since your investments expand over time by gaining passion. Retired life planning allows you to sock away adequate cash to preserve the same way of life you currently have.

Every person dreams of the day they can ultimately bid farewell to the workforce as well as retire. Doing so sets you back cash. That's where retired life planning comes right into play. And also no matter at which point you are in your life. Sure, you may have Social Protection advantages, however that may not suffice, specifically if you're utilized to a particular way of living.

Not known Factual Statements About Wealth Management

We have actually created a step-by-step overview that can assist you prepare your retired life. Lots of investment alternatives can aid you conserve for retirement. Some options may bring in higher dangers; others might aid you safeguard your riches. We comprehend that growing your money securely is essential. This is why we you could try these out have designed retired life plans that fit your requirements.It is necessary to have an emergency situation fund to depend on. This can assist you in your hour of demand and cover the expenses of unplanned costs. When investing your money, make certain that you conserve properly for any type of unforeseen economic requirements. Life insurance coverage can guard your enjoyed ones with a safety financial protection in your lack.

When getting ready for the future, attempt to pick different kinds of investment options that place your cash in varying property classes, industries, and sectors. By doing this, if you experience a loss in one investment or if one alternative does not perform per your assumptions, you can rely on the others.

For example, if you desire to clear up in a brand-new city, your month-to-month expenses might be higher, depending on the city. Similarly, if you like to take a trip, you may invest much more on traveling expenses in retired life than a person that favors being at home. Your wants can help you pick an ideal plan that can generate Get More Info adequate returns.

The 2-Minute Rule for Wealth Management

Nonetheless, these can differ depending on the strategy you look at these guys choose. Retirement normally allow you to pick the costs you wish to pay in the direction of your strategy, according to your needs. A greater premium might bring about a higher earnings during your retired life. The vesting age is the age at which you can start obtaining your pension or revenue from the plan.Report this wiki page